Key Canadian Growth Plays

Surge offers exposure to two of the top five conventional oil growth plays in Canada: the Sparky & SE Saskatchewan. Each of these plays provides exceptional economics and a depth of drilling inventory.

Greater Sawn

Concentrated light oil asset with conventional Slave Point reefs.

Sparky

Light/medium crude oil production with compelling returns. Low on-stream costs with extensive drilling and waterflood inventory provides excellent long term sustainable growth potential.

SE Sask

Highly focused, operated asset base with excellent light oil operating netbacks. Low-cost wells with short payouts. Potential for continued area consolidation.

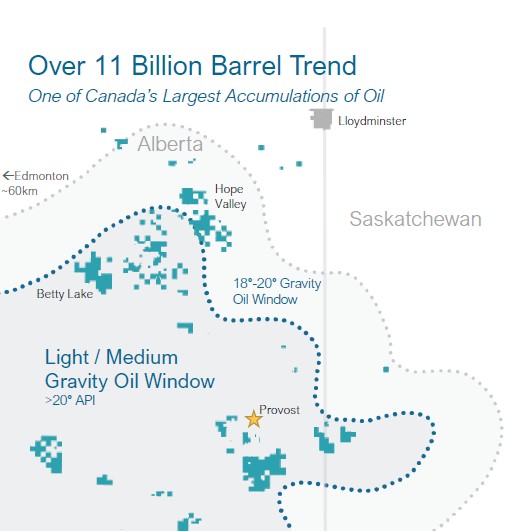

Sparky

A One-of-a-Kind Position

Surge holds a dominant land position and is drilling a mix of horizontal multi-frac and horizontal multi-lateral wells in the Sparky area

- Large, well established oil producing fairway in Western Canada

- Increased market focus with operators implementing multi-lateral horizontals in areas of higher oil viscosity; being compared to the Clearwater

- Per well economics with quick payouts and excellent rates

- Conventional sandstone reservoirs support top-tier capital efficiencies

- Shallow depth (700-900m)

- Low geological risk due to 3D seismic and thousands of vertical penetrations

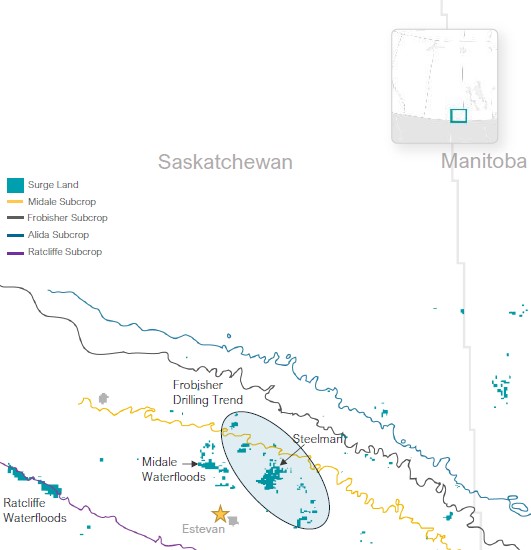

SE Saskatchewan

A Light Oil Balance

Surge’s operational track record of success in SE Saskatchewan makes this an exciting growth area

Area Benefits

- Organic growth opportunities

- Strategic acquisitions or tuck-in consolidation opportunities

- Cost-efficient drilling

- Extremely quick turnaround from spud to on production (under two weeks)

- High operating netback ($47.50 at $70 WTI)

- Mix of low decline waterfloods & highly economic drilling

- Assets have low liabilities; minimal inactive ARO

- Year-round access